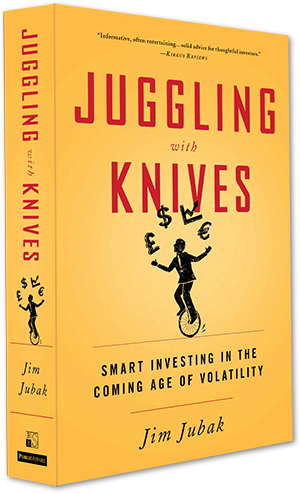

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Pick #8 Qualcomm in my “10 New Stock Ideas for an Old Rally” Special Report

Today I added Qualcomm as Pick #8 for my Special Report “10 new stock ideas for an old rally” on my subscription JubakAM.com site The stock is already a member of my Volatility Portfolio on that subscription site. Here’s what I wrote

Yes, I’d buy Palo Alto Networks today–with these caveats

After yesterday’s earnings report–the company beat Wall Street estimates for the quarter–and radically lower guidance for next quarter and the rest of 2024–total billings for next quarter will grow by just 2% to 4% and revenue for all of 2024 will grow by just 15% to 16% from 2023–shares of Palo Alto Networks (PANW) took a big hit right between the eyes. The stock fell 28.44% at the close and lost $104.12 a share to $261.97. What do I recommend? I’d say “buy” with a couple of caveats. Why buy?

Please Watch My New YouTube Video: Quick Pick Nvidia Hold Through Earnings on August 23

Today’s Quick Pick is Nvidia (NVDA)–Hold Through Earnings on August 23. Nvidia reports late in this quarter’s earnings season, and this report is expected to be very good. Wall Street’s expectations range from a low of 75 cents a share to a high of $1.75 but the consensus is $1.66 a share, up from 32 cents last year. Nvidia has been reporting 30% positive surprises in recent quarters, so there’s a good chance the results may be even better than expected. My suggestion is to hold the stock through this report in August, and then think about selling. I know, I know. Sell Nvidia!? That’s crazy! Here’s the thing. At some point, Nvidia’s growth rate is going to start to slow. When it does, people will look at the stock and decide the slower growth rate may not

Microsoft soars on earnings, so I’m selling the shares I bought for my Volatility Portfolio

Back on March 24, I added shares of Microsoft (MSFT) to my Volatility Portfolio on the thinking that in a quarter when earnings were projected to be down for the Standard & Poor's 500 as a whole, reliable technology growth stocks such as Microsoft would outperform....

Gold pushes toward all-time high

Gold for June delivery closed at 2039.00 an ounce on the Comex today. That’s not too far away from the all-time record high of $2,070 an ounce. The move above $2,000 an ounce and any breach of the record at $2070 could trigger a rally as traders short gold buy to cover positions. That could well be true, but I’d note that this forecast of a gold rally is coming from traders long gold who are trying to talk a rally into being.

Oil rallies, finally

Oil rallied today, Monday, March 27, for the first time in, well, quite a while. Oil is likely to finish with a loss in March, for a fifth monthly drop. So today’s move, which saw West Texas Intermediate jump by almost 55, marked quite a shift in direction.

Please Watch My New YouTube Video: Quick Pick KBE Bank Stocks ETF

Today’s Quick Pick is SPDR S&P Bank ETF (NYSEARCA: KBE). I’m not suggesting buying this now: I’m suggesting you watch this and buy Put Options on this ETF when the time is right. The SPDR S&P ETF is approximately 80% regional banks. As you can imagine, it took a huge hit during the recent banking scare and would have been a great Put Option last week during the plunge in the sector. Options are a way to leverage the volatility of this market. The recent exit of my VIX Call Option resulted in a 100% gain in about a week. For KBE, I’d look at Put Options that climb in value as the price of the ETF sinks. At the time of recording, KBE was selling at about 37. I’m looking at the June 16 Put at a strike price o 38. At the moment, the Put is deeply underwater but I’ll continue to watch this rally to see when it’s worth it to jump in. At the moment, I suggest you watch this one: Don’t buy just yet but wait for the next shoe to fall in the banking crisis.

Adding Equinor as another energy play to my Jubak Picks Portfolio tomorrow

Today, Wednesday, February 8, Equinor (EQNR) reported a record $74.9 billion adjusted operating profit for 2022. That more than doubled the previous record. If you’re looking to add an energy stock to your portfolio ahead of a year that looks likely to be a good one for energy stocks, I’d suggest Equinor. I’ll be adding it to my Jubak Picks Portfolio tomorrow with a target price of $40 a share.

Is the VIX volatility index “broken” or is this a trading opportunity?

I vote for the latter–even though I acknowledge that the VIX, the CBOE S&P Volatility Index (VIX), which is supposed to track expectations for short-term volatility in the market, is behaving very strangely lately. The VIX is supposed to climb along with fear in the market as investors and traders step up to buy options and futures, even at higher prices, in order to hedge risk. But even as stocks have struggled in December the VIX has tumbled. It was down another 5.01% today to just 20.87.

AbbVie raises dividend again–but only by 5%

Once a company has put in the time and money to make the Dividend Aristocrats list, the company isn’t likely to squander that investment just because a recession looms. To make the list–and garner a big chunk of cash from conservative dividend investors–a company has had to pay a dividend for a least 25 consecutive years and has had to raise that dividend every year. A company like 3M (MMM), which owns a 64-year record of paying and raising its dividend payout, is as close to a dividend sure thing as exists. Which is why it’s not surprising that AbbVie (ABBV), which owns a 50-year record of paying and raising its dividend, announced that it would raise its dividend in 2023 to $1.48 a quarter with the February 2023 payout. That would bring the annual dividend yield to 3.5% But…