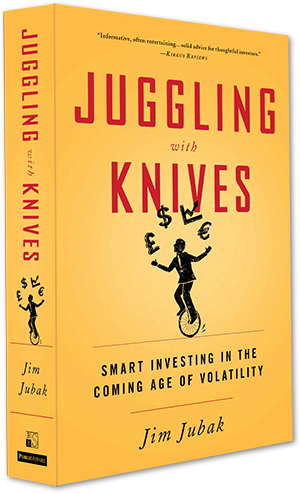

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Selling my VIX July and August options to complete my roll over into the November Call

Last Friday I recommended a buy of the November 17, 2021 Call Options on the CBOE S&P 500 Volatility Index (VIX) with a strike at 18 for a new hedge in increased stock market volatility in the fall. The 3.32% drop that day to 15.44 took the index, which measures how much investors and traders are willing to pay to hedge against volatility in the S&P 500, took out the low for the VIX for 2021 and you have to go all the way back to February 10, 2020–before the pandemic knocked the stuffing out of stocks–to find a lower level for the “fear index” at 13.68. My thought on this buy was that at this price I was getting a chance to hedge volatility at a level that would generate a profit even if we didn’t get a big volatility event. Since that buy that Call Option (VIX211117C00018000) has climbed to $5.75 from my buy at $5.20 with a gain of 2.68% today. The VIX itself has edged high both today and yesterday to a close on June 29 at 16.11, up 2.22% on the day.

Rolling over my Call Options on the VIX as volatility fears continue to fall

Investors and traders are less afraid of a drop in stocks than at any time in 2021. The CBOE S&P 500 Volatility Index (VIX), which measures how much investors and traders are willing to pay to hedge against volatility in the S&P 500, is down another 3.32% to 15.44 today, June 25, as of 3:30 p.m. New York time. The drop took out the former low for the VIX for 2021 at 15.65. I have to go all the way back to February 10, 2020–before the pandemic knocked the stuffing out of stocks–to find a lower level for the “fear index” at 13.68. So today I’m buying Call Options on the VIX–which will go up if fear and the index climb for November 2021 with a strike at 19.

On the market’s risk complacency, I’m adding another VIX call to my Volatility Portfolio–this one for October

The CBOE S&P Volatility Index (VIX) dropped 8.9% on Friday, June 4, to 16.44. It’ up just slightly today to 16.73 (up 1.89%) as of 2 p.m. New York time. That’s, in my opinion, an extremely low reading on the fear index considering how many potentially market moving volatility events we’ve got ahead of us over the next six months. (For a list see my Special Report: 5 picks and 5 hedges for a falling market on my JubakAM.com subscription site.) So today, June 7, I’m adding another Call Option on the ViX to my Volatility Portfolio.

Selling Build-A-Bear Workshop out of my Volatility Portfolio

When I added shares of Build-A-Bear Workshop (BBW) to my Volatility Portfolio on March 31, 2021, I was thinking that the stock would move up in price as pandemic restrictions that had forced the closing of most of the company’s stores eased. The company had made a huge and successful shift to online selling and I thought that Build-A-Bear would be able to continue that success as well as reap the revenue gains that would come from the reopening of its brick and mortar stores. But I certainly didn’t expect the stock to gain 103.91% from then until the close on May 26. The stock climbed another 39.31% today on the release of earnings and is now up 100.14% in the last three month; 78.10% in the last month, and 56.33% in the last week. I’m selling the shares today, May 27, on the great news in the earnings report for the quarter.

Selling my Disney Call Options today ahead of Friday’s inflation volatility

The Disney July 16 Call Options (strike price $170) are up another 17.98% today, May 25, as of 1:30 p.m. New York time to $9.91. I’m going to make my profit in this option position today ahead of the potential volatility later this week ahead of Friday’s big inflation data release. I bought these options back on May 17 at $7.17 a contract. I’m closing the position with a 32.6% gain.

Will this re-discovered coffee species save your morning jamoke from global warming?

Researchers looking for a way to improve the tolerance of the Arabica coffee plant that accounts for 56% of global coffee production may have found their cuppa in Sierra Leone. Coffea stenophylla grows at a mean annual temperature up to 12.24 degrees higher than Arabica. And coffee tasters say, according to Bloomberg, it has a flavor similar to Arabica rather than to the more temperature tolerant Robusta coffee used now in instant and other bulk coffees. Global coffee production is threatened by rising temperatures

Hold off on those VIX hedges for a bit–a robust start to earnings season from the big banks this week could send the “fear index” even lower

Over the weekend I posted that I’d be looking at a possible buy of Call Options on the CBOE S&P 500 Volatility Index (VIX) today–depending on how the VIX behaved in the Monday action. Today the VIX regained some of the ground that it gave up last week, closing ahead 1.92% to 1701 after closing at 16.69 on Friday. And I’m going to hold off on buying VIX Call Options until I see the trend in first quarter earnings reports.

Want a little more earnings leverage on “vaccine rally” pick Wyndham Hotels? Try this Call Option

Back on March 17, I added shares of Wyndham Hotels and Resorts (WH) to my Jubak Picks Portfolio because I thought the stock was among those issues most likely to climb in a "post-vaccine rally." Sine then the shares are up 3.39% as of 3 p.m. on April 7. But in my last...

Take what the market is giving you: Three short-term moves for short-and mid-term gains

The one certainty in the stock market right now, I’d say, is volatility. Both to the upside and to the downside. So I think we should take what the market is giving us. Using these three moves in the short term.

Electric vehicle charging stocks are on fire today on Biden infrastructure plan

Shares of Chargepoint (CHPT) were up 15.40% as of 2:30 p.m. New York time today, March 31. Charging station competitor Blink Charging (BLNK) was up 8.69%. The big jump came on speculation that the Biden administration’s infrastructure plan with its emphasis on growing the number of electric vehicles in use would include incentives and money for expanding the woefully inadequate U.S. network of charging stations for electric cars.