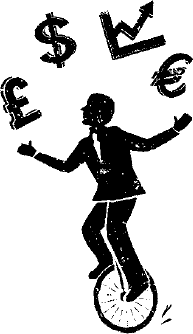

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

It’s a bull market on inflation fears and scary Fed forecasts–which is actually a good thing

The fact that forecasts of higher interest rates have run amok is actually a positive for the financial markets. This is how Wall Street typically changes gears, going from the excessive optimism and downright complacency of November to a bull market on inflation fears by January.

People’s Bank moves to juice China’s economy earlier than I expected

Today, the People’s Bank of China cut its key interest rate for the first time in almost two years to help support China’s economy. The People’s Bank of China lowered the rate at which it provides one-year loans to banks by 10 basis points. Not a huge move–100 basis points equals one percentage point–but earlier than many economists–and I–had anticipated.

I often recommend using Call Options to profit from earnings season volatility–not this time

This earnings season looks so tricky that I’m going to sit it out rather than attempt to leverage moves in the shares of reporting companies by purchasing either Call (a bet that the stock will go up) or Put (a bet that the stock will go down) options.

With sell of Apple tomorrow I’ll start to unwind my end of the year rally buys

When I bought shares of Apple (AAPL) in my Jubak Picks and Volatility Portfolios, I was looking for gains from the end of the year rally (which kind of fizzed out) and the traditional Santa Claus rally (which came through as expected) to drive shares higher in the short term. Since that November 23, 2021 pick, shares of Apple, as of the close today January 4, were up 12% to $179.70, just above my $179 target price for this short-term trade.

Remember that volatility creates volatility–time to look to some tax loss selling (like Nektar)

With the VIX “fear index” falling back closer to “normal” levels–it dropped to 21.89 yesterday from 31.12 on December 1–it sure feels like the extreme volatility of the end of November and early December is on the ebb. The move to yesterday’s 21.89 close from December 1 was was a surge of 30% in the CBOE S&P 500 Volatility Index in a week. This move away from panic follows on a jump in the “fear index” in the week from November 24 to December 1 of 67% in the opposite direction. I’d be surprised if we don’t see another surge in volatility in the rest of December or in January with what promises to be a crazy earnings season, but even if volatility holds at something like today’s level–slightly elevated from the historical averages but in the rough ballpark–don’t forget that volatility has a long tail. Volatility, in fact, creates volatility. And not least of all in individual stocks.

Why is Apple green today when everything else is red?

Even as losses accelerate for almost all stocks as we head into the close today–the Standard & Poor’s 500, which was down 1.31% at 2:30 In New York had moved to a loss of 1.74% as of 3:30–shares of Apple (AAPL) continue to hang onto the green.

Apple is Pick #5 for my Special Report: It’s a Market Melt Up!! on my subscription JubakAM.com site (and for my Jubak Picks and Volatility portfolios)

It was sure hard to see a market melt up today, November 22. The Standard & Poor’s 500 was down 0.32% and the NASDAQ Composite fell 1.26%. Market leaders in the melt up rally like Applied Materials (AMAT) and Microsoft (MSFT) were down 1.65% and 0.96%, respectively. And it was even harder to see the trend I thought might be on its way in my Friday, November 19 post “Forward into the past with tech stocks:We’re seen this market before.” The rotation into tech stocks that I saw on Friday turned into loses of 3.12% for Nvidia (NVDA), and 1.92% for Alphabet (GOOG.)

But I suggest that you take a look at Apple’s (AAPL) performance today

Selling remaining Treasury ETFs out of my portfolios

On what looks like solid odds for interest rate increases in 2022, I’m selling my remaining Treasury ETFs out of my portfolios.

Apple is Pick #5 for my Special Report: It’s a Market Melt Up!! on JubakAM.Com. (And for my Jubak Picks and Volatility portfolios tomorrow)

It was sure hard to see a market melt up today, November 22. The Standard & Poor’s 500 was down 0.32% and the NASDAQ Composite fell 1.26%. Market leaders in the melt up rally like Applied Materials (AMAT) and Microsoft (MSFT) were down 1.65% and 0.96%, respectively. And it was even harder to see the trend I thought might be on its way in my Friday, November 19 post “Forward into the past with tech stocks:We’re seen this market before.” The rotation into tech stocks that I saw on Friday turned into loses of 3.12% for Nvidia (NVDA), and 1.92% for Alphabet (GOOG.) But I suggest that you take a look at Apple’s (AAPL) performance today

Buying Tesla in my Volatility Portfolio tomorrow

Yesterday I picked Tesla (TSLA) as No. 14 in my Buy on the Dip Special Report. I put the stock in a group along with Advanced Micro Devices (AMD) and Nvidia (NVDA) that I called Buy on the Regret. These were stocks that lots of investors who didn’t yet own wanted to own and would bid up at the the least opportunity. But I wrote yesterday, I thought Tesla shares had been pounded so hard in the last few days that I quick reversal was unlikely. I’d prefer to buy when I’d seen shares stabilize or drift high. Wrong. Which is why they play the game and not simply decide who wins by comparing the lineups. Today Tesla shares closed up 4.34% on the day.