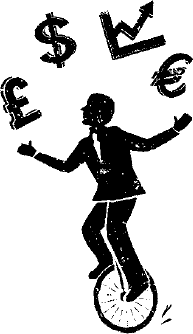

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Expect earnings fireworks when Tesla reports on Wednesday, April 20, after the market close

Forget about all the hoopla over Tesla (TSLA) founder Elon Musk’s bid to buy Twitter (TWTR). (If you can.) On Wednesday, when the electric car leader announces first quarter 2022 earnings the story will be China, China, China.

Please watch my new YouTube video: “Time to buy oil on the dip”

We’ve had a pretty good dip over the last few days in oil prices. I think that comes from a trading pullback from a quick run-up in prices, as well as optimism that the war in Ukraine will not last as long as people had thought. The oil stocks I added to my portfolios in January have done quite well. In this video, I look at a few of them: ConocoPhillips (COP), Pioneer (PXD), Cheniere (LNG), Equinor (EQNR), and the Energy Sector SPDR (XLE). I think many of these are set to continue rising as we see continued gains in raw material prices; plus, it doesn’t hurt that some pay a healthy dividend as well!

Is this stock market too directionless to be tradable in the short-term?

I’m not putting on any leveraged bets on market direction at the moment. The trend is just too “trendless.”

Watch my new YouTube video: “Trend of the Week Low VIX in a risky market?”

This week’s Trend of the Week asks Why, despite all the turmoil in the markets, has the CBOE Volatility Index–also known as the VIX, or the “Fear Index,” remained so low? I think this should signal to us that the market has not currently worried in the near term about long-term problems it knows are coming down the road, like rate hikes and a recession at the end of 2022 or in 2023.. In the VIX’s short-term view, there’s no need to worry. Time to put a call on the VIX?

Oil is up, stocks (outside energy) are down–how long will this anti-correlation last?

Oil rallied again today with U.S. benchmark West Texas Intermediate up 4.79% on the day to $114.79 a barrel and international benchmark Brent up 5.12% to $121.39 a barrel. So, naturally, oil and gas equities stocks are up today. And the broader market is down. What else isn’t new?

Norway’s Equinor gets adjusted permits to raise natural gas production

Norwegian oil and natural gas producer Equinor (EQNR) said Wednesday, March 16, that adjusted permits from the Norwegian government will allow higher natural gas production over summer from the North Sea Troll and Oseberg fields as well as the Heidrun fields in the Norwegian Sea. With European countries looking for alternatives to Russian natural gas Equinor can basically sell all the gas it can produce even at higher prices. Natural gas futures closed at $4.81 per million BTUs today in New York. That’s up from $3.80 on January 20. That’s a 26.6% increase. I added Equinor to my Volatility Portfolio back on January 21 as hedge against a Russian invasion of Ukraine and wide-reaching sanctions. That position is up 23.14% as of the close on March 18.

Raising some cash and reducing some risk by selling my two shipping stocks out of my Volatility Portfolio

Back in October 2021 (on October 7 to be exact) I added shares of Danaos (DAC) and Navios Maritime Partners (NMM) to my Volatility Portfolio. Disruptions in the global supply chain had produced a bidding war by companies willing to pay almost anything to get their goods, components, and raw materials from Point A to Point B. And these two shipping giants were positioned to reap the rewards of that chaos. Today, though, the chaos is on the other foot (so to speak).

Oil breaks above $90 for first time since 2014

U.S. crude benchmark West Texas Intermediate rose above $90 a barrel–it closed at $90.87, up 0.60% for the day, for the first time since 2014. International benchmark Brent crude gained 0.42% to close at $91.53 a barrel. Of course, it took a wild confluence of events to push prices above $90.

Putting on those emerging market hedges ahead of schedule–today, right now–buying EWZ and EWW Put Options

When I posted over the weekend that coming increase in interest rates from the Federal Reserve and the possibility of soaring energy prices from a Russia/Ukraine conflict and the ensuring sanctions by Western allies against Russia constituted a double whammy on emerging market assets and developing economies. A strong dollar and higher U.S. interest rates would exacerbate a looming debt crisis (yes, yet again) in the developing world, and higher oil and natural gas prices (and tighter supplies) would hit developing economies really really hard. I said then that I’d be looking for hedges to insure against and profit from the downside risk in emerging market assets. Well, things have moved faster than I expected

Putting on hedges for a Russia-Ukraine conflict today (as in NOW)

I only recommend options on my subscription sites JubakAm.Com and JugglingWithknives.com. And this week on those sites I've closed the two VIX CALL Options I bought back on December 31 as protection (and potential profits) from an increase in market volatility exactly...