Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

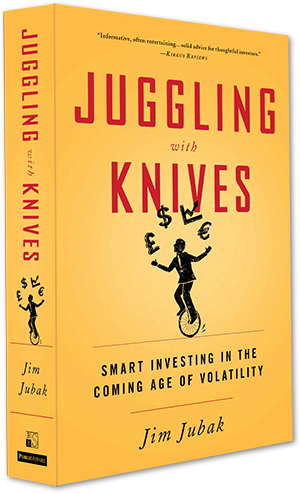

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Alcoa Call Options seeing action ahead of July 21 earnings report

I’m seeing a lot of traders buying Alcoa (AA) Call Options ahead of the company’s July 21 earnings report. The action seems to be most concentrated on the $70 October 21 Call at $75. The stock closed at $64.10 today, June 6, up 3.53%. I think the Call Buying is a result of the very big spread in estimates for second quarter earnings with the high estimate at $4.01 and the lost at $3.19. The consensus for the quart is at $3.66. That would be a huge gain from the $1.49 reported in the second quarter of 2021.

Please watch my new YouTube video: Quick Picks Wyndham Hotels

My one-hundredth-and-thirty-fortieth YouTube video “Quick Pick Wyndham” went up today. My Quick Pick this week is Wyndham Hotels (WH), which owns a large portion (40%) of the U.S. market in branded economy and midscale hotels. This is gearing up to be a big summer for travel as the economy emerges from the pandemic, and I think inflationary pressures will “encourage” many consumers who decide to travel to look to save a buck or two on their trips. I will add shares of Wyndham Hotels and Resorts to my Volatility Portfolio on Monday, June 6

EU agrees to partial ban–66%–of Russian oil imports

The European Union has finally found a way to agree on a partial ban on oil imports from Russia. The group has agreed to an immediate ban on imports arriving by sea. That covers about two-thirds of Russian imports. To get Hungary’s vote for the partial ban, the EU agreed to exempt oil transported through the Druzhba pipeline.

Palo Alto Networks beats, raised guidance again, gains 10.7% in after-hours trading

I’m actually surprised that shares of cyber-security company Palo Alto Networks (PANW) rose only 10.7% in after-hours trading after the company reported adjusted fiscal third quarter earnings of $1.79 a share. That was ahead of the adjusted earnings of $1.68 a share expected by analysts and it was up from $1.38 a share in the fiscal third quarter of 2021. Revenue of $1.39 billion, up from $1.07 billion a year ago, was ahead of analyst projections of $1.38 billion. Billings rose to $1.8 billion from $1.27 billion in 2021. But the big news, the news that powered the after-hours gains, came when executives at Palo Alto raised their full-year outlook for the third time in as many quarters

Everything EV was up today on news of soaring new registrations

New registrations for electric vehicles jumped 60% in the first quarter of 2022 from the first quarter of 2021. according to Experian Automotive. Electric vehicles made up an all-time record 4.6% of the total market. The news was even more positive given that overall new vehicle registrations were down 18% in the quarter from the first quarter of 2021.

A day after bad news of an economic slowdown in China, officials talk up China’s Internet giants

Today, Tuesday May 17, China’s top economic official, Vice Premier Liu He, said that the government will support the development of digital economy companies and their public stock listings. The comments delivered after a symposium with the CEOs of some of the country’s largest private technology companies came just a day after the National Bureau of Statistics reported that industrial output fell 2.9% in April from April 2021, and that retail sales contracted 11.1%. Financial markets in China and the United States interpreted the remarks as a public show of support for China’s Internet companies

Today it looks more like a bear market rally

In my weekend Saturday Night Quarterback I said that this week would, probably, answer the question of whether Friday’s big bounce was just a bounce, the start of a buy on the dip rally, or even a bear market rally with a bit of staying power. Two days into the week I think the market action is moving in favor of a bear market rally, one of those often quite powerful upside moves that punctuate extended bear markets.

AMD reports solid earnings beat after close on May 3

After the close on May 3, Advanced Micro Devices (AMD) reported first-quarter earnings of $1.13 a share, excluding some items. Wall Street analysts had projected earnings of 92 cents a share for the quarter. Sales rose 71% to $5.9 billion, topping projections of $5.3 billion. The results pushed shares up 9.10% in trading on May 4.

This week is last stand for growth stock earnings hopes

Going into this earnings season, the hope was that strong, surprisingly strong perhaps, earnings from the big growth stocks would put a stop to the selling. Earnings would be strong enough to convince investors that the market wasn’t over-valued since at these growth rates stocks would be seen to be quick growing into current extended valuations That hasn’t exactly worked so far. But this week the earnings story from growth stocks hits its stride. If the companies reporting this week can’t make the case for growth stock earnings, there probably isn’t a growth stock story to be made in the light of Federal Reserve interest rate increases, supply chain disruptions, and fears of a recession.

Please watch my new YouTube video: “Quick Pick Plug Power”

My one-hundredth-and-twenty-fifth YouTube video “Quick Pick Plug Power” went up today. Plug Power is building out a network for green hydrogen and hydrogen fuel cells. They’ve been involved in recent big deals with Walmart to power fork lifts in the company’s warehouses. And the company has Amazon, another big warehouse operator, as a customer too.The other market I like for Plug Power is backup power for data centers. This stock is very volatile, so be careful out. I’ll be adding it to my Volatility Portfolio on JubakAM.com on Monday after the April 22 drop of 3.54%