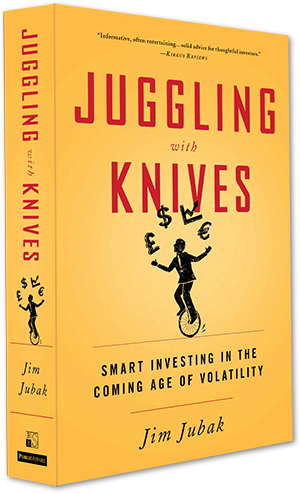

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Rally or rotation? I vote for rotation

In the last week Technology stocks, and chip stocks in particular, have staged a very impressive rally off of a really low base. Nvidia (NVDA), for example, is up 17.43% in the week that ended on July 21. That still leaves the stock down 39.43% for the year. Advanced Micro Devices (AMD) is up 15.36% in the last week. And it’s still down 37.85% for 2022. Qualcomm (QCOM) is up 1.85% for the week. And down 16.26% for the year. Impressive. But I’d be more inclined to see this as a sustainable rally if stocks were rising across the board–with tech and chips leading the way, perhaps.

Instead what I’m seeing is a rotation from safe and less risky stocks

Remember, natural gas isn’t just for heating; air conditioning demand sends natural gas for August delivery up 10.2% today

There are the base-load power plants that run all the time and meet the bulk of normal electricity demand. And then there are the power plants that are only intermittently called into service when demand spikes. In the United States the majority of the plants used to meet “spiking” demand run on natural gas. So you can imagine what something like the current heat wave now gripping much of the country does to electricity demand for air conditioning and to demand for natural gas.

Today chip stocks climbed on prospect for Senate vote on $50 billion subsidy bill

The bill, known as the Chips for America Act, is a pared-down version of a broader set of competition measures and would authorize $52 billion in grants and loans for chip manufacturers, as well as a new, four-year 25% investment tax credit for chip making. Senate Majority Leader Chuck Schumer has pressed for a vote today with final passage as early as next week.

Please Watch My YouTube Video: “Two Ideas for Shorting Emerging Markets”

I’m firmly in the negative camp on emerging markets. If you want to profit from the downward move in these markets, I see two options: one is investing in a fund that shorts emerging markets, like EUM. Or, two, you can buy put options on a fund like EMXC (which tracks emerging markets minus China). There are benefits and downsides to each approach.

Adding Invesco Dollar Bullish Fund ETF to three portfolios

In my July 7 YouTube video: “Quick Pick UUP” I added the Invesco DB U.S. Dollar Index Bullish Fund (UUP) to my Perfect 5 ETF Portfolio. (To replace the Consumer Staples Select Sector SPDR ETF (XLP) in that portfolio. More on that in another post today.) Today I’m also going to add this dollar ETF to my Volatility Portfolio and to my Jubak Picks Portfolio. I’m setting a target price of $33.20 in the Jubak Picks Portfolio. You should take the fact that I’m adding a dollar position to three portfolios as an indication of how strongly I feel about a continued strong dollar.

Please Watch My New YouTube Video: Quick Pick Cheniere Energy

My Quick Pick this week is Cheniere Energy (LNG), a liquified natural gas producer that I currently own in my Volatility Portfolio on JubakAM.com and plan to add to my Jubak Picks portfolio as well. The stock has fallen as U.S. natural gas prices have taken a hit after a fire at the Freeport liquified natural gas facility that has caused a backup in U.S. LNG exports. I think it’s a great time to get in on this long-term story at Cheniere, which just announced that it had given the go-ahead to the construction of a new LNG chain at its Corpus Christi facility. That chain won’t be in operation until 2025 but I see the demand for U.S. LNG continuing to rise through then.

Biting the (Federal Reserve) bullet and selling two yield ETFs out of my Dividend Portfolio

I’ve probably overstayed my welcome in the Vanguard Short-Term Treasury ETF (VGSH) and the VanEck Preferred Securities ex-Financials ETF (PFXF), but with the Federal Reserve accelerating its interest rate increases, I think selling these two members of my Dividend Portfolio is a bit more pressing right now.

The speculative money is alive and “well” during Bear Market rally days

Friday, June 17, was a modestly up day for most of the indexes. The Standard & Poor’s 500, for example, gained 0.22% and the NASDAQ was up a stronger 1.43%. (The Dow Jones Industrial Average lost 0.13% on the day.) But you’d never know that the indexes were up only modestly if you checked the gains on the most speculative stocks in the market. Meme favorites GameStop (GME) and AMC Entertainment (AMC) were up 7.48% and 6.28%, respectively. But the speculative gains didn’t stop there.

Buying U.S. Natural Gas Fund in my Jubak Picks Portfolio

I’m using the continued weakness in natural gas prices and in the U.S. Natural Gas Fund (UNG) to add the shares to my Jubak Picks Portfolio. The U.S. Natural Gas Fund was down another 5.90% today to close at $23.78.

It’s a war of two narratives–today “recession” narrative replaces “rate cut” narrative and stocks fall heavily

Yesterday, the stock market was up with the Standard & Poor’s 500 gaining 1.46% on the day and the NASDAQ Composite up 2.49%. Listening to the Federal Reserve’s policy statement after the June 15 meeting of its Open Market Committee, Wall Street chose to hear a promise of interest rate cuts as early as the end of 2023 and certainly in 2023. Aggressive interest rate increases in 2022, from this perspective, are just a necessary precondition to those interest rate cuts. Today, the stock market is down with the Standard & Poor’s 500 falling 3.25% and the NASDAQ Composite off 4.08% at the close. The narrative on investors’ and traders’ minds today is the rising odds of a recession–75% odds in favor by 2024 a Bloomberg survey of economists says with 25% odds of a recession in 2023. For a day that trumps the hopes for 2024 interest rate cuts (which would, after all, only materialize if the economy has, indeed, tumbled into recession. I expect this “War of the Two Narratives” to continue for a while