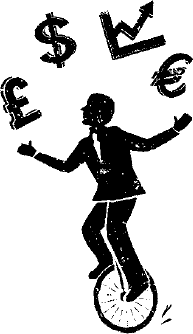

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Buying Puts on Brazil ETF on today’s emerging market rally and worsening coronavirus recession in Brazil.

I understand why U.S. and European stocks are up so strongly today on news that the rate of new infections is dropping in Spain and Italy and that New York looks to be on a similar path with a possible peak in coronavirus cases sometime in the next week to 10 days. But what I can’t understand is why emerging markets are up so heavily on the news. Okay, I can understand why the iShares MSCI Emerging Markets ETF is up so much.

Market climbs on 6.65 million new claims for unemployment? Buying Starbucks Puts

As I said yesterday, if the market went up on bad initial claims numbers, I’d be buying Put Options (a bet that stocks will falling) and doing some more selling. There are signs that the market is rethinking it’s initial optimism (based partly by President Donald Trump saying that he will broker an end to the Saudi-Russian oil price war.) The S&P 500 was up 1.88% at 11: a.m. and up 1.48% at 11:15 a.m. So I’m going to catch that optimism–misguided in my opinion–by buying the August 21 Put Options on Starbucks (SBUX) with a strike price of $62.50.

I’m using today’s bounce to buy Disney Puts–I don’t think we’re done with the bear

Shares of Walt Disney Company (DIS) were up 3.53% in today’s general market bounce. The Standard & Poor’s 500 was up 85.18 points, of 3.35%, to 2626 today. My conclusion is that we’re still in the midst of a bear market rally and that stocks will resume their downward trend once investors focus again on how much damage still lies ahead of the economy due to the coronavirus pandemic. I still believe that a recession is likely during the first and second quarters of 2020 in the United States, the European Union, and Japan with growth in China standing a good chance of dipping into negative territory in the first quarter of 2020. With that in mind I’m looking for more chances to make a profit on the downside and Disney looks to be a likely candidate.

Play it again, Nvidia–I’m putting my Nvidia puts back on in what I think is a bear market rally

Back on March 10 I bought Put Options, a bet that a stock will fall, on Nvidia (NVDA). I sold those Puts on March 17 for a gain of 106%. When I bought the Puts Nvidia traded at $261.08 a share. When I sold those Puts Nvidia traded at $219.7 a share. The shares have rebounded to trade at $259.88 today, March 25, at 2:30 p.m. on the rumor and then the news of a $2 trillion coronavirus rescue package. I think the huge bear market/short-covering rally of the last two days won’t hold once enthusiasm over that $2 trillion runs into the realities of how long and how deep the coronavirus recession is likely to be. Economists are already talking about the need for another rescue package since that $1200 per adult check isn’t going to last until we turn the corner on the coronavirus recession. So it’s time to buy those Nvidia puts again.

In a bear market panic, it’s really, really hard to figure which way stocks will jump on any particular day

Yesterday, I sold my Put options on Nvidia (NVDA) and Apple (AAPL) with gains of around 100% in each since I added them to my Volatility Portfolio on March 10. I’d bought those Puts in order to make some money from the falling prices of those stocks and the market in general. As I read the market tea leaves yesterday morning, stocks were likely to rally in the days ahead as the Senate passed the House of Representatives’ first coronavirus relief bill and took up a much bigger $1.2 trillion bill that included such things as a $1,000 or $2,000 check to each American and $300 billion in aid for small businesses. I didn’t want to hold those negative bets on a further decline in Apple and Nvidia shares in the face of that “good” news. But instead today, March 18, I got a huge sell off in U.S. stocks. The Dow Jones Industrial Average opened down 1,300 some points. The Standard & Poor’s 500 index was down by as much as 9.78% as of 2:30 p.m. New York time before rallying at the end of the trading session to a closing loss of “just” 5.18%. So my sells on those Puts yesterday wound up leaving money on the table. I’m okay with that.

Selling my Nvidia and Apple puts on talks of $850 billion stimulus package

Today, on the wave of optimism in the markets over Washington talks about a $850 billion coronavirus stimulus package, I’m going to sell the two put options–Apple and Nvidia–that I bought on March 10. I don’t want to give back my gains. And I look to rebuy these bets on falling stock prices when reality bites optimism in the behind in a few weeks.

Adding Nvidia puts as “bear protection and profit play” to Volatility Portfolio

Earlier today I sold shares of Nvidia (NVDA) out of my Jubak Picks portfolio out of worry that we are looking at a further market dip that’s likely to be especially hard on technology momentum stocks. Now I’m adding put options on Nvidia in my Volatility Portfolio

Putting on those Apple puts in today’s rally

One reason I decided to wait yesterday to put on those Apple (AAPL) September 18 puts (AAPL200918P00250000) in my Volatility Portfolio until today was a hope that the extremely wide bid/ask spread of Monday would narrow so that the put options wouldn’t be as expensive.

Tomorrow adding Apple Puts to Volatility Portfolio as a hedge on market panic

But just in case the today’s panic ushers in more panic tomorrow, and just in case that the already negative news on so many fronts turns more negative, I’d also like to put on a hedge to give me a little more upside in case markets continue to fall. (I’ve already got a full complement of Treasury ETFs in my portfolios plus gold and some exposure to the Japanese yen. The iShares 7-10 Year Treasury Bond ETF (IEF), for example, is up 6.94% in the last month. The Invesco Currency Shares Japanese Yen (FXY) is up 4.19% in the last month. Of course, you could hedge using the S&P 500 itself but my preference is to spend less money on a contract and get more leverage by going with a put on a single widely owned and heavily represented in the indexes stock, such as well Apple (AAPL.)

What now for Treasuries and their ETFs? Should you be buying even at record low yields? I’m adding shares of Vanguard’s 1-3 year Treasury ETF

I’d wager that almost nobody today is buying U.S. Treasuries for their yield. The yield on the 10-year Treasury broke below 1% to 0.9043% for the first time EVER. The 10-year finished the day with a yield of 1.01%. The yield on the 2-year Treasury fell to a low of 0.6223% before closing at 0.71%. But traders and investors are buying.