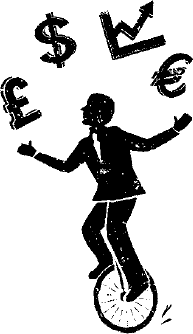

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Selling Agenus and Amyris out of my portfolios

Just want to make sure that everyone caught this sell decision that I made first on my subscription JubakAM.com website. I’m selling Agenus (AGEN) and Amyris (AMRS) out of both my Jubak Picks and Volatility portfolios.

Now there are two Puts supporting the market as the Vaccine Put joins the Powell Put

First, there was the Powell Put, the conviction of Wall Street and investors that the Federal Reserve would ride to the rescue to support stock prices if financial markets or the economy threatened to tumble. And then, of course, there’s the second Put, the Vaccine Put, which prevents bad economic news from gaining much traction and lets individual stocks shake off company-specific negative news.

Gold hits a record: Now what?

Spot gold hit an all-time high today to close at $1991.40 an ounce. In July gold rose 11%, the most since 2012. And now even investors and traders who never own gold are looking at the metal and say, “Should I buy? Will it rally some more?” In my opinion it’s late to jump on the band wagon. Gold isn’t about to correct, at least not in the short term, but the big driver for higher gold prices–the weak U.S. dollar–looks closer to a reversal than to another extended move lower. For the near term, I’d look to be a seller with an eye toward buying when the dollar has played out a limited upward move.

Beijing takes one more swipe at overheated Chinese stocks today

The Chinese economy returned to growth in the second quarter with gross domestic product climbing 3.2% in the quarter from the June quarter of 2019. That was a recovery from the 6.8% drop in GDP in the first quarter and the results beat projections for 2.4% growth. Nonetheless, stocks fell in Shanghai and Shenzhen today with the Shanghai Stock Exchange Composite dropping 4.5% and the CSI 300 index falling 4.81%. As is frequently the case in the Chinese stock markets, driven as they are by individual investors, the money followed pronouncements from state-own media.

So how much worse will things get for Wells Fargo? Continuing to hold my Put Options but maybe taking a little profit

On today’s bad news from JPMorgan Chase (JPM), Citigroup (C), and, especially, Wells Fargo (WFC), the Wells Fargo Put Options (WFC201016P00025000) I hold in my Volatility Portfolio had gained 20.62% to $3.10 as of 2 p.m. New York time today. That still leaves this position underwater since I added these Puts (strike price $25) to the portfolio back on April 6, 2020 at $3.70. But these Puts still have a long time to run

Banks start off earnings season by pouring cold water on V-shaped recovery

“I don’t think anybody should leave any bank earnings call this quarter simply feeling like the worst is absolutely behind us and it’s a rosy path ahead,” Citigroup (C) CEO Michael Corbat said this morning as he announced the bank’s second quarter earnings. “We don’t want people leaving the call simply thinking the world is a great place and it’s a V-shaped recovery.”

Disney parks re-open in Florida as state hits record new coronavirus cases; Hong Kong park closes again

On Sunday, Florida reported the highest single-day total of new coronavirus cases by any state since the start of the pandemic. The 15,299 new cases surpassed the previous high for any state on a single day of 12,274 recorded in New York on April 4. The record comes just one day after Disney re-opened its Magic Kingdom and Animal Kingdom parks in Orlando.

Wells Fargo to cut thousand more jobs this year; bank reports earnings on July 14

Wells Fargo (WFC) will cut thousands of jobs later this year, Bloomberg reported today. The bank, the largest employers among U.S. banks, is facing intense pressure to cut costs. So far in the coronavirus economic downturn,U.S. banks have resisted large-scale layoffs. Could the move by Wells Fargo be a turning point for the sector?

How I’m positioning ahead of earnings season uncertainty

As I wrote in my earlier Morning Brief, the stock market seems to be selling (generalization I know) what I’m calling “re-opening dependent” stocks. And nervous about the tech stock winners that have led the recent days in this rally ahead of next week’s earnings season. What should you be watching/doing right now?

Wells Fargo says it will cut its current dividend after Fed stress test

Wells Fargo (WFC) said today that it will cut its current 51-cent dividend after the Federal Reserve’s most recent round of stress tests set new limits on dividend payouts and share buybacks. The bank said it will announce the size of the cut on July 14 when it announces quarterly earnings. Analysts expect a cut to 20 cents a share.