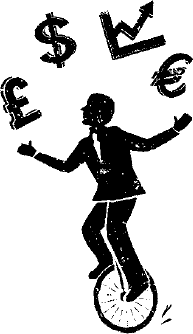

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Autoliv beats on prospects for global auto recovery–but I think you’ve got better stocks to play this trend

Autoliv (ALV) reported third quarter earnings per share of either $1.48 (non-GAAP) or $1.12 (GAAP). (GAAP is generally accepted accounting principles.) That consensus was $1.09 a share on Wall Street. Revenue of $2.04 billion was in line with expectations and up 0.5% year over year. For the full 2020 year the company said it expects a 14.5% drop in revenue–versus Wall Street projections for a 15.05% decline. While those results may seem lackluster, they represent a huge improvement for the maker of auto safety systems.

Tomorrow, October 21, I’m adding Puts on iron producer Vale on likely increase in global supply surplus

Vale’s share price has climbed 16% in 2020. So I’m going to buy Put options, betting on a miss (or at least rising fear of a miss) or other negative news on iron ore supplies and prices in my Volatility Portfolio. This, need I say, is a short-term trade.

Catching up on my October 5 buy of Twilio

This is something of a catch up post. On October 5 I added Twilio (TWLO) to my Jubak Picks and Volatility portfolios. I announced that buy in a post on October 2 and then again in my Special Report: “Your Investing Guide for the Next 6 Dangerous Stock Market Months” on my JubakAm.Com site I noted it as a buy. But somehow I never quite posted it to those two portfolios. Something I’m fixing today.

Taking short-term profits in Wells Fargo Put options tomorrow–will look to rebuy

On October 8 in my Special Report “Your Investing Guide to the Next Dangerous 6 Stock Market Months” on my JubakAM.Con site I recommended buying Puts on Wells Fargo (WFC) for my Volatility Portfolio as a way to hedge stock market volatility. If you had bought the January 15, 2021 Puts with a strike price of $22.50 the next day, October 9, you would have paid just $1.06 (or $106 for a contract of 100 shares for the Put.) Today, on the bad earnings news from Wells Fargo, the stock dropped 6.02% to close at $23.25.

Today was a good day to add those GOLD and GDX risk hedges

In my Special Report “Your Investment Guide for the Next 6 Dangerous Stock Market Months” on my JubakAM.com site I wrote “I’m pessimistic about the month before the election and for the lame duck months after it. I think there’s a chance either in the United States or in Europe of some really scary developments on a spike in the pandemic and on a slowing economy. I think it’s worth buying a little insurance on that bad case scenario. And gold is the best way to hedge against an extreme event.” In short, gold prices will go up with any significant increase in worry and uncertainty. Which means that buying gold shares of Call options on gold is a way to hedge your portfolio against rising uncertainty.

Buying gold Call Options as a hedge on drop in economy and stocks in Lame Duck November and December

So that’s what I’m buying today (for execution tomorrow in essence since it’s 3:56 p.m. in New York as I write this) for my Volatility Portfolio

Adding Puts on American Airlines tomorrow on Trump’s call to end stimulus talks

As I’ve posted in my Special Report on my JubakAM.com site, I had been waiting for shares of American Airlines (AAL) to move farther above $13 before adding Put options to the Volatility Portfolio. And over the last few days, the stock had moved above $13 to hit $13.36 today, October 6, at 2 p.m. New York time. And then President Donald Trump said he was rejecting the latest $2.4 trillion coronavirus stimulus offer from House Democrats and ordering Treasury Secretary Steve Mnuchin to end his talks with House Speaker Nancy Pelosi.

Why the President’s positive test for coronavirus led to a rally today in airline stocks

Every investor and trader has spent much of today speculating (either in words or dollars) on what President Donald Trump’s positive coronavirus test might mean for stocks. The Standard & Poor’s 500 closed the day, October 2, down 0.96% and the Dow Jones Industrial Average fell 0.48%. The NASDAQ Composite and the NASDAQ 100 dropped 2.22% and 2.83%, respectively. The market hates uncertainty so the White House news plus bad news on the September employment report would be expected to produce a down day.So why did airlines stocks move up?

Buying MGM Puts on today’s bounce: Prologue to my Special Report My Special Report “Your Investing Guide for the Next Six Dangerous Stock Market Months” with 10 investment moves for a crazy, crazy market.

I’m not waiting until I post on my JubakAsset Management site all of my newest Special Report: “Your Investing Guide for the Next Six Dangerous Stock Market Months with 10 investment moves for a crazy, crazy market” to make this buy on the MGM Resorts International (MGM) Puts with a strike price of $20 and a December 18 expiration. The underlying stock closed at $21.65 today, up 2.63%. I’ll be adding these Puts (MGM201218P00020000) to my Volatility Portfolio tomorrow.

With Vaxart you get Volatility–here’s why it’s so extreme

Yesterday shares of Vaxart (VXRT) were up 46.79%. Today they’re down 16.13% as of noon in New York. And, of course the shares are down 55.38% since I bought them on July 22, 2020 at $14.79. Why so much, such extraordinary volatility?