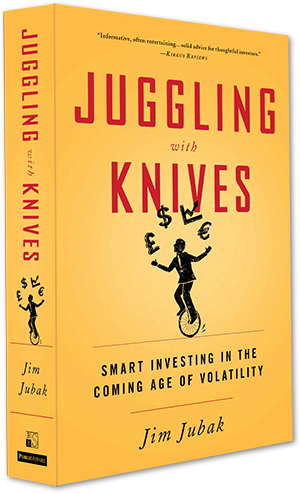

Juggling With Knives: Profits, protection and planning for volatility in stocks, bonds, real estate, and real life.

Jubak’s Picks

Stocks for a

12-18 Month Horizon

Performance

2019

+10.2%

2018

+10.2%

2017

+13.2%

Since Inception

+584%

Top 50 Stocks

50 Best Stocks in the World

Performance

2019

+21.19%

2018

-8.22%

2017

+28.1%

2016

+21.5%

Dividend Income

Stocks That Pay You

Performance

2021

+18.59%

2020

+15.71%

2019

+4.90%

2018

-15.52%

2017

+6.48%

2016

+26.8%

Volatility

Exploiting Temporary Market Trends

Performance 2017:

+53.06%

Perfect 5 ETFs

Active/Passive Portfolio

Performance since

October 2017

+23.46%

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website is based on my book, Juggling with Knives. Both the book and website are about volatility in everything from stocks and bonds to real estate, and real life topics such as jobs and education.

This website keeps the content of the book fresh and the advice and strategies up to date. If you’ve purchased the book, you’ve earned a one-year free subscription. Use the Coupon Code in the book to start your one-year FREE SUBSCRIPTION when you Subscribe on this website.

I run two other investing websites, Jubak Picks and Jubak Asset Management. So how does Juggling With Knives fit in that group? With a subscription at $79 a year you get everything that appears on my free JubakPicks.com website (1 to 2 posts a day plus buys/sells/updates on three portfolios) plus an additional 1 or 2 posts a day, including a special post on volatility on most days, plus access to my new Volatility Portfolio. My premium site, Jubak Asset Management, JubakAM.com to its friends, offers for $199 a year everything on Jubak Picks, plus everything on Juggling With Knives, plus exclusive posts that include Sector Monday, Friday Trick or Trend, Saturday Night Quarterback, and my daily Notes You Can Use Mini Blog. Oh, and videos where my smiling face explains the markets. If you’d like to step up to a JubakAm.com subscription click here. (You’ll get full credit for what you paid to subscribe to Juggling With Knives.)

Post of the Month

These are the Free once-per-month posts for non-subscribers.

Click Here to view all of Jim’s daily posts!

Vaxart is looking like a “short-squeeze rocket”–is it?

Ok, I don’t want to see “the next GameStop under every rock.” But Vaxart (VXRT) deserves a look or two. (The stock is a member of my Volatility Portfolio where it’s up 5.27 as of the close on February 1 since I added it to the portfolio on July 22, 2020. I also own shares in my personal portfolio.) Here’s what I see with the shares of this company that is in clinical trials of a vaccine for the coronavirus. Vaxart’s vaccine is a pill and it’s the only vaccine pill under development. Shares of Vaxart are up (as of the February 1 close) 54.93% in the last week and 172.68% in the last month. They’ve added 216.46% in the last 3 months and are up 172.68% for 2021 to date as of the close on February 1. The shares moved up another 29.97% today to $15.57 a share.

Watch my YouTube video on why this very stretched market will hang in for another six months

I’m starting up my videos again–this time using YouTube as a platform. The fourth YouTube video on why this very stretched market will hang in for another six months went up today.

2020 was a great year for Dividend investing: my Dividend Portfolio showed a total return of 15.71% for 2020

It’s unusual, to say the least, to have a dividend portfolio match the returns on the Standard & Poor’s 500–especially in a year when the S&P 500 was setting an all time high–but that’s what happened in 2020. My Dividend Portfolio showed a price gain of 12.28% for 2020. Add in the 3.43% dividend yield and the total return for the portfolio for the year was 15.71.% For the year the S&P 500 returned 16% and the Dow Jones Industrial Average returned 7%.

Watch my YouTube video on what Apple and Microsoft’s moves on Intel mean for technology stocks

I’m starting up my videos on–this time using YouTube as a platform. The third YouTube video on What Apple and Microsoft’s moves on Intel mean for technology stocks went up today.

Closing all of my Options hedges in the Volatility Portfolio; holding off until January or February to add new downside protection

Stock have moved up so strongly that the Put Options I own in my Volatility Portfolio are no longer providing any significant downside protection against a market downturn. Especially since two of the three–the Puts on MGM Resorts International, and Vale l expire on December 18. The last Put, the one on American Airlines, expires on January 15, 2021, but I’m closing that position as well. I’m also selling my two Call Options on Barrick Gold, and the VanEck Vectors Gold Miners ETF since they also expire on December 18 and they are also so far out of the money the holding is pointless. Those Calls on gold were also added as protection against an outbreak in market volatility that never arrived.

Can’t swim against the cash flood anymore–selling my ProShares Short Russell 2000 ETF out of the Volatility Portfolio tomorrow

I bought the ProShares Short Russell 2000 ETF (RWM) back on October 30 because I felt then that the market wasn’t pricing in any of the potential problems likely to hurt the U.S. economy over the next couple of months. I picked the small cap Russell 2000 index for my downside bet because it was showing the most sensitivity to news–good and bad about the economy. Well, I got the sensitivity part right. But I missed the effect of huge cash inflows on stocks in general and the Russell in particular. Right now potential bad news and even actual bad news doesn’t matter much. Stocks keep going up. At the close on December 9, Wednesday, I had a 19.89% loss in this position after today’s slight 0.69% drop in the Russell 2000 (and 0.72% gain in this short ETF.) I’m not willing to let this loss get any bigger so I’m selling this position.

Taking my 200% gain in Kensington/QuantumScape today and selling this position

Shares of what was once Kensington Capital Acquisition (KCAC) and is now QuantumScape (QS) are up 203.3.7% since I bought Kensington back on October 13, 2020 in my Volatility Portfolio. But Quantumscape isn’t planning to have its solid state lithium ion battery in production until 2024. And most investors don’t understand the wave of dilution that’s about to hit the now public shares of QuantumScape. So I’ll be taking my profits tomorrow.

Cast your vote today for the Kensington merger

If you bought shares of Kensington Capital Acquisition (KCAC) along with me on October 13, you’re received a solicitation for a proxy vote to approve the reverse merger of Kensington with privately held QuantumScape, a startup solid state lithium battery company. The merger is a way for QuantumScape to go public. (Kensington was the 14th and last pick in my Special Report: 10 Stocks for the Post-Coronavirus economy on my JubakAM.com subscription site. I added it to the Volatility Portfolio on October 13. Kensington has called a special meeting for shareholders for November 25 to approve the merger. You can vote online until 11:59 p.m. tonight. I plan to vote in favor of the merger, since that’s the whole reason for owning shares of Kensington. Kensington is a SPAC.

Watch your Puts as a source of cash in any dip: My Puts on Vale and American Airlines move into black

Intended as insurance against a big market drop, my Puts on American Airlines (AAL) and Vale (VALE) have moved into the black in the last two days. My Puts on MGM Resorts International (MGM) could follow–the stock dropped 5.55% in after-hours trading yesterday on a big revenue miss for the third quarter.

Buying ETF to short Russell 2000 (and U.S. economic growth) tomorrow to add more downside protection

Yesterday, October 28, I posted that I would put off buying more downside protection against volatility in this nervous market for one more day. The plunge in stocks on Wednesday made downside protection more expensive–fear increases the demand for downside hedges–and the uncertainty introduced by the release on Thursday of third quarter GDP growth figures (with the possibility that the market would rebound strongly from Wednesday’s drop) both argued for waiting until Friday, October 30 to buy my next hedge. Well, the GDP news is behind us and the market climbed relatively modestly today, which made hedges cheaper, so tomorrow I’ll be adding shares of the ProShares Short Russell 2000 ETF (RWM) to my Volatility Portfolio.